The Fractional CFO Knowledge Center

Search the Knowledge Center

Knowledge Center Articles

AI, Values, and Vulnerability: The New Risk Management Mandate for CFOs

AI governance and risk for CFOs is no longer a future concern—it is a present-day finance mandate. As artificial intelligence rewires forecasting, controls, and decision-making, both the upside and downside ultimately land with the CFO. This is no longer a technology conversation. It is a risk management, governance, and enterprise value conversation. Why AI Governance …

What Is ESG, and Why Is It Important for Small Companies?

ESG stands for Environmental, Social, and Governance. It’s a framework used to evaluate how responsibly a company operates—from how it manages its environmental impact to how it treats people and how leadership makes decisions. While ESG is often associated with large corporations, it is becoming increasingly relevant for small companies too. Customers, employees, lenders, investors, …

Future-Proof Your Business Starts With Better Leadership

The best way to future-proof your business starts with humility, respect, and a continuous desire to improve. Beyond mindset, it requires a proactive and strategic approach that balances risk management, technology adoption, and long-term financial discipline. In an environment defined by uncertainty, CFOs and business leaders must shift from reactive decision-making to deliberate, forward-looking strategy. …

What CFO Do You Have vs What You Need – Do You Even Have One?

What CFO do you have vs what you need is a question many business owners never stop to ask. As companies grow more complex, financial leadership must evolve beyond reporting numbers to guiding strategy, growth, and decision-making. What CFO do you have versus what your business actually needs? Modern CFOs are no longer just number-keepers. …

AI for Small Businesses: Why You Should Invest and Integrate Now

Artificial Intelligence is no longer reserved for global tech giants. AI for small businesses has become accessible, affordable, and practical across nearly every industry. Cloud computing, subscription pricing, and user-friendly platforms have democratized AI. Today, even the smallest company can leverage tools that were once exclusive to large enterprises. Whether you’re ready to implement AI …

Three Months of Noise vs Ten Years of Signal: Rethinking Fractional CFO Leadership

A few days ago, in a virtual meeting, I met a fractional CEO. On paper, we looked similar: both fractional, both C-suite, both working with owners who want more from their businesses. Within minutes, however, it was clear that we see our role — and our responsibility to results — very differently. When I mentioned …

From Culture War to Cost Control: A CFO’s View on Contract Discipline

Walt Disney once said, “It’s kind of fun to do the impossible.” For many organizations, especially in today’s cost-constrained environment, the “impossible” is maintaining growth and margins while expenses quietly drift upward. From a CFO’s seat, that challenge often comes down to one thing: contract discipline. The Pentagon’s recent review of its 8(a) contracting program …

Doing the Impossible: A CFO’s View on Growth in the SME Market

Walt Disney once said, “It’s kind of fun to do the impossible.”For many small and medium-sized enterprises (SMEs), the “impossible” shows up daily as limited resources, tight cash flow, and intense competition. From the seat of a fractional CFO, I see these constraints not as barriers, but as the starting point for disciplined, strategic growth. …

AI Risk Management for CFOs: Values, Vulnerability, and Control

AI risk management for CFOs is no longer optional.As artificial intelligence reshapes finance workflows, controls, and decision-making, the CFO is where both the upside and downside ultimately land. AI is no longer a side experiment. It is actively rewiring forecasting, compliance, controls, and risk allocation across the finance function. Why AI Risk Management Matters for …

From Daydream to Done: How SMBs Turn Vision into Executable Strategy

Fractional CFO services for small businesses help turn vision into execution by grounding strategy in budgets, cash flow, and financial discipline. Without that structure, even the best ideas remain daydreams. Vision without execution is easy. Execution without financial clarity is expensive. For small and midsized businesses, the bridge between the two runs directly through strategy, …

Three Months of Noise vs Ten Years of Signal: Rethinking Fractional Leadership

Long-term fractional CFO leadership is not designed for quick wins or flashy case studies. Instead, it exists to create durable, compounding value that holds up over years, not quarters. A few days ago, during a virtual meeting, I met a fractional CEO. On paper, we looked similar: both fractional, both C-suite, both working with owners …

Numbers Don’t Lie: Strategy Is a Guess, Execution Is Proof

Strategy execution and financial metrics are the only reliable way to separate confident leadership from wishful thinking. Every major decision—new markets, products, systems, or org structures—starts as a hypothesis about the future. Until that hypothesis shows up in the numbers, it remains a story. The space between the slide deck and the profit and loss …

Beyond the Balance Sheet: Bringing Real Clarity and Visibility to Your Business

Financial clarity for business owners is the difference between reacting to surprises and making confident, proactive decisions. A qualified fractional CFO turns scattered numbers into a clear, usable roadmap for cash, profit, and growth—so owners stop flying blind and start leading with certainty. Too many growing businesses rely on disconnected reports, bank balances, and gut …

Discovery That Changes the Room: How Fractional CFOs Create Real Clarity

The fractional CFO discovery process is not a “nice-to-have” kickoff meeting. Instead, it is the moment where both the business owner and the CFO are changed by what they learn about the business, the numbers, and each other. When done well, discovery becomes the foundation for every decision, KPI, cash-flow model, and strategic recommendation that …

Why You Should Never Run Your Business on Bank Balance Alone

Introduction As a fractional CFO, I continually tell business owners: do not run your business on your bank balance alone. Here’s why this approach puts your company at serious risk. Relying solely on your bank balance is simplistic and misleading. It leads to poor financial decisions and unnecessary risk exposure that can undermine even profitable …

Emotional Attachment in Business Leadership: How Things Go Wrong Fast

Emotional attachment in business leadership often undermines otherwise healthy companies. When owners avoid hard decisions to preserve relationships or comfort, operational dysfunction accelerates quietly. Over time, value erodes faster than most leaders expect. In this case study, weak governance, misplaced trust, and limited financial oversight combined to push a profitable business toward unnecessary risk and …

Decisions Are Scenarios, Not Bets

Every major business move—expansion, hiring, pricing changes, or launching a new product—should start with scenario analysis for business decisions, not gut instinct. Rather than relying on hope or intuition, strong leaders use scenario planning to explore plausible outcomes, understand risk, and protect cash flow before committing capital. At each decision point, it helps to pause …

How CFOs Can Minimize Supply Chain Disruptions and Dependencies

Minimizing supply chain disruptions and dependencies is no longer just an operations issue—it is a core financial and risk management priority. For CFOs, the challenge is balancing cost efficiency with resilience so the business can absorb shocks without destroying margins, cash flow, or customer trust. A proactive, finance-led approach helps turn supply chain resilience into …

Assessing Hybrid Work, Unlimited PTO, and Flexibility in Small Businesses

Flexible work policies in small businesses, including unlimited PTO, flexible working hours, and hybrid work models, are becoming increasingly common as employers compete for talent and rethink productivity. When implemented thoughtfully, these policies can improve efficiency, leadership effectiveness, and cost control. When poorly designed, they can introduce inequity, weaken internal controls, and create hidden financial …

9 Questions That Show You’re Not Ready to Engage a Fractional CFO

If you are asking the questions below, you may not be ready to engage a fractional CFO. Each of these questions shrinks the relationship, limits upside, and reflects a misunderstanding of what a CFO actually does. When expectations are misaligned, even a strong fractional CFO will struggle to deliver meaningful value. A fractional CFO becomes …

From Cost Center to Profit Engine: When You’re Not Ready for a Fractional CFO

If you are asking the questions below, you are not ready to engage a fractional CFO. Each one shrinks the relationship, limits upside, and reflects a misunderstanding of what a CFO actually does. When expectations are misaligned from the start, even a great fractional CFO will struggle to deliver value. A CFO becomes a profit …

From Garage Projects to Cash Flow: Why DIY CFO Work Costs More Than You Think

Many entrepreneurs and business leaders, myself included, learned a DIY mindset early on. It often starts in the garage. Can you relate? How many projects did you get right on the first try, and at what cost? DIY can be fun, relaxing, and even rewarding. In business, however, DIY often comes with a different price: …

The True Cost of DIY CFO Work

Many clients, entrepreneurs, and business leaders share a strong DIY mindset, and for a long time, I was one of them. The DIY CFO vs fractional CFO decision often starts the same way: handling finance internally feels cheaper and more controlled. But like most “one-day projects,” CFO work without the right plan and partner usually …

Data Visibility Enhancement and Key Benefits for CFOs in 2025

In 2025, data visibility has become a critical driver of financial performance. From a CFO’s perspective, having clear, real-time access to financial and operational data enables smarter decision-making, improved forecasting, and sustainable growth in an increasingly complex business environment. This article explores the key benefits of data visibility and the strategies CFOs can use to …

Why a Fractional CFO Is a Powerful Risk Mitigation Strategy for SMBs

Small and mid-sized businesses (SMBs) face a complex web of risks that grow as the company scales. For businesses under $5 million in revenue, these risks are often unmanaged—not due to negligence, but due to lack of access to senior financial leadership. A fractional CFO provides strategic, CFO-level expertise on a part-time basis, helping SMBs …

How Emotional Intelligence Drives Better Financial Discipline

Emotionally intelligent leadership is not a soft skill—it is a core driver of financial discipline, sound decision-making, and reliable execution. For founders, entrepreneurs, and executives, avoiding emotional decision traps directly improves budgeting accuracy, forecasting quality, and capital allocation outcomes. When leaders apply emotional intelligence (EI) to financial leadership, the numbers become clearer—and easier to act …

The Risks Small Companies Can’t Afford to Overlook

Many small businesses under $5 million in revenue operate under constant pressure. Owners juggle sales, operations, and hiring while financial management is often pushed aside. Even when leaders know they need CFO-level guidance, they delay—most often because of perceived cost. What’s frequently missed is this: avoiding the right financial leadership is far more expensive over …

Financial Resilience in Business: Keep Going When It Gets Hard

“If you’re going through hell, keep going.” The quote is often attributed to Winston Churchill, though there’s no verified record that he ever said it verbatim. Regardless of its origin, the message resonates—especially in business leadership and finance. In volatile markets, financial resilience in business is not about avoiding difficulty. It’s about navigating uncertainty with …

Why Hiring a Fractional CFO Is Like Calling an Expert Mechanic for Your Business

Imagine you’re driving your car and suddenly hear an unusual sound coming from the engine. You might not know exactly what’s wrong, but you recognize that ignoring it could lead to serious problems down the road. In business, financial warning signs serve the same purpose—and that’s where a fractional CFO becomes essential. Declining cash reserves, …

Main Responsibilities That Differentiate the CEO from the CFO

Understanding CEO vs CFO responsibilities is critical for business owners, boards, and leadership teams. While both roles are essential to organizational success, their priorities, decision-making authority, and accountability differ in meaningful ways that directly impact strategy, execution, and financial performance. CEO: Chief Executive Officer Strategic Leadership The CEO sets the company’s vision, mission, and long-term …

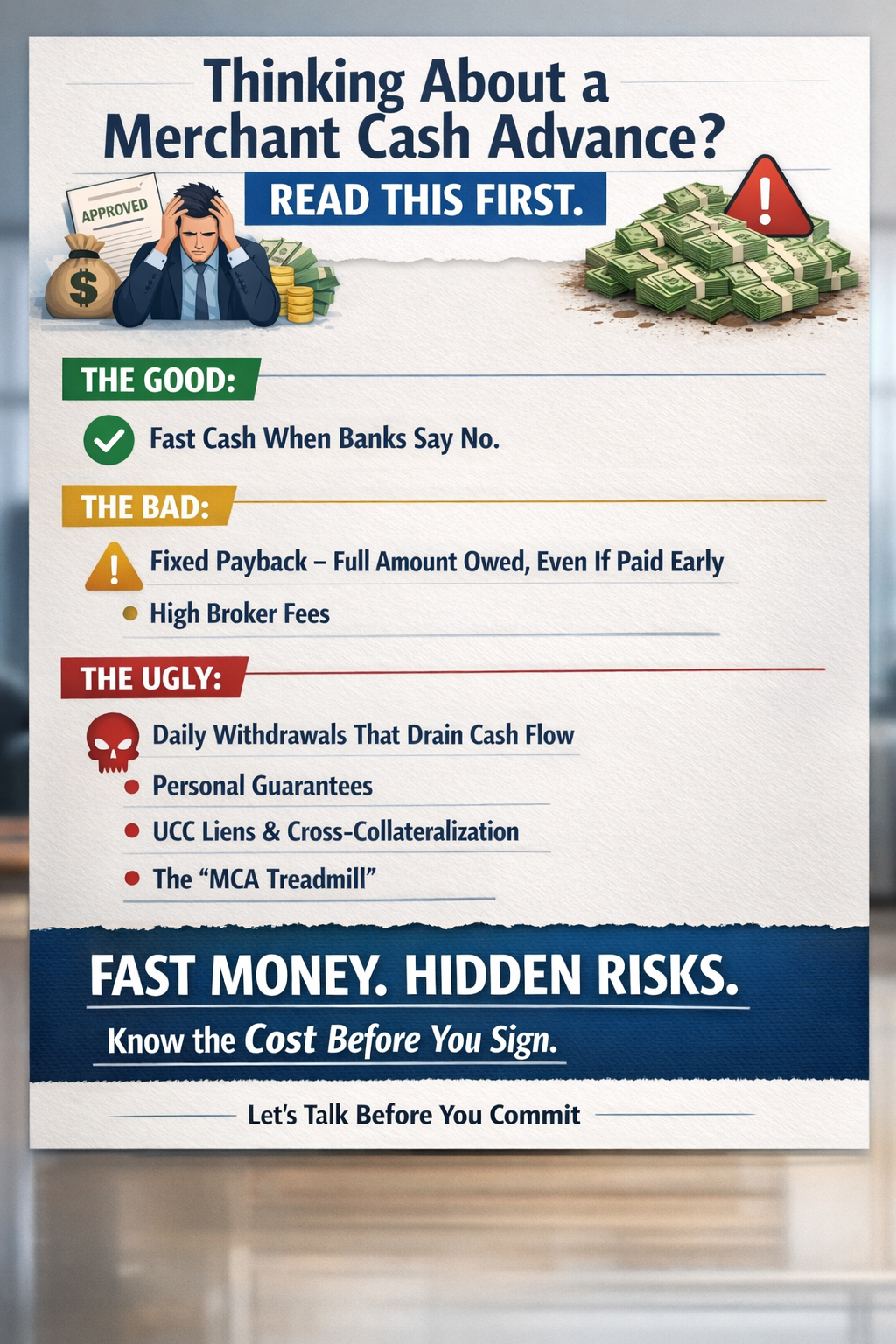

Cash Strapped? Considering Merchant Cash Advance Loans?

The Good, the Bad, and the Very Ugly When cash is tight, merchant cash advance loans can look like a lifeline. Fast funding, minimal paperwork, and quick approvals make MCAs attractive to business owners under pressure. But speed comes at a cost—and in many cases, that cost is far higher than advertised. Before signing an …

What’s Your Next Move?

An Economic Environment Strategy for Businesses in 2025 The current economic landscape presents a complex mix of risk and opportunity. For leaders navigating inflation, tariffs, labor shifts, and changing consumer behavior, having a clear economic environment strategy for businesses is no longer optional — it is essential for protecting margins, preserving cash, and sustaining growth …

The Secret of Change: Socrates’ Wisdom for Modern Business Leaders

Socrates once famously said, “The secret of change is to focus all of your energy, not on the old, but on the new.”While rooted in ancient philosophy, this insight is deeply relevant to today’s business environment , where leadership and change management determine whether organizations stagnate or transform.” Organizations now face constant disruption—from emerging technologies …

10 Key Takeaways for Business Owners from a Fractional CFO Discovery Process

Engaging a fractional CFO for a discovery process is more than a preliminary engagement — it is a strategic deep dive into the financial and operational realities of your business. This phase uncovers risks, identifies opportunities, and establishes a clear foundation for sustainable growth. Below are 10 key takeaways business owners gain from a well-executed …

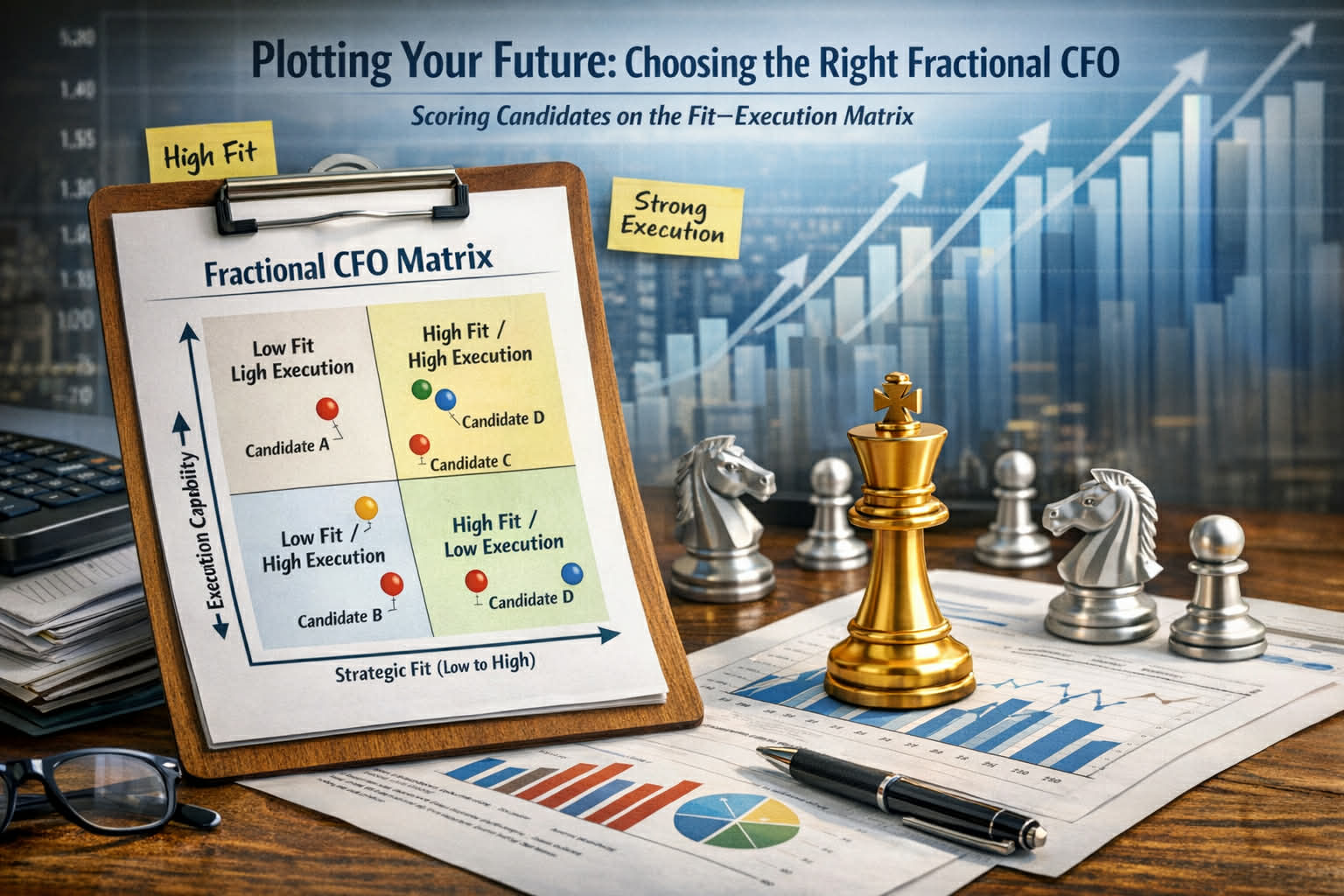

Plotting Your Future: Why Choosing the Right Fractional CFO—and Scoring Them on a Fit–Execution Matrix—Can Make or Break Your Business

Choosing the right fractional CFO is one of the highest-leverage decisions a founder or CEO can make. The right partner elevates strategy, sharpens execution, and protects enterprise value. The wrong one quietly amplifies risk, stalls growth, and erodes credibility with lenders and investors. Because fractional CFOs sit at the intersection of strategy, cash, and execution, …

High-Margin vs. Low-Margin Businesses: What Owners Really Want

Business owners often say one of two things: “I wish I were in a high-margin industry.”—or—“I wish I were in a low-margin, high-volume business.” Both statements reflect a deeper tension between per-unit profitability and scale. Each model offers real advantages, real risks, and very different demands on leadership, cash flow, and execution. Understanding the difference …

Pivot or Die: Aligning Strategy, Execution, and Cash Flow

Pivot or Die is a powerful reminder that in today’s economy, standing still is often the most dangerous strategy a leader can choose. Gary Shapiro’s framework around strategic pivots is especially relevant for founders and CEOs whose ambitions are beginning to outpace their cash. In volatile markets, growth alone is not enough. Sustainable success depends …

Bridging the Gap: Aligning Financial Realities With Leadership Growth Priorities

Every successful organization dreams big—market expansion, product innovation, digital transformation, and long-term value creation. Leadership teams define ambitious growth priorities designed to future-proof the business and capture new opportunities. But too often, financial capabilities don’t fully align with those ambitions. Bridging the gap between financial goals, financial capacity, and leadership’s growth priorities isn’t just a …

If It’s Important, It’s Written Down

Why This Matters for Leaders In high-performing organizations, clarity is not accidental—it’s designed. One of the simplest and most effective leadership principles is this: If it truly matters to the business, it’s written down. Strategy, priorities, decisions, and commitments only become real when they live somewhere other than in someone’s head. Documentation is not bureaucracy—it’s …

Clarity That Hurts vs. Hopeful Confusion: A Fractional CFO’s Perspective for SMB Owners

“Clarity that hurts you is better than the hopeful confusion that holds you.” That line has stayed with me because it reflects what I see every day—both personally and in my work as a fractional CFO for small and mid-sized businesses. Hopeful Confusion vs. Painful Clarity Hopeful confusion sounds like: Painful clarity sounds like: One …

Always Be Closing the Gap: Turn Every Sale Into Cash, Clarity, and Growth for Your SMB

For many small and mid-sized businesses (SMBs), growth looks strong on paper—but cash flow tells a different story. Sales are coming in, revenue is rising, yet financial pressure remains. This disconnect is what I call “the gap”—the space between sales, cash flow, and true financial clarity. If you want sustainable growth, you must always be …

10 Critical Benefits of a Business Financial Assessment (GAP Analysis)

A business financial assessment, often referred to as a GAP Analysis, is more than a financial checkup—it’s a strategic tool that helps organizations improve performance, reduce risk, and plan for sustainable growth. Regardless of size or industry, every business benefits from regularly evaluating its financial health. Here are 10 critical benefits of conducting a financial …

What’s Your Next Move in This Economic Environment?

As we move through 2025, businesses are navigating a complex economic landscape shaped by inflation, tariffs, labor shifts, and changing consumer expectations. Here’s what leaders should be paying attention to—and where to focus next: Economic Environment Inflation sits around 3%, raising operational costs and tightening margins. Companies should double down on cost control, outsourcing, and …

10 Biggest Operational Challenges Construction Companies Face

Construction companies operate in a complex, project-based environment where financial accuracy and operational efficiency directly affect profitability. Here are the 10 biggest operational and accounting challenges construction firms face today—and how to address them. 1. Inaccurate Cost Estimation Poor cost estimating is one of the primary reasons construction projects run over budget. Complex scopes, bad …

Why We Do It: The Purpose Driving Every SMB

Every small and mid-sized business (SMB) starts with a spark—a belief that work can mean more than hitting goals or making payroll. It’s the conviction that what we build matters. That choice brings freedom, pride, and responsibility. Simon Sinek said, “Working hard for something we don’t care about is called stress; working hard for something …

The Why? It’s important to me. Is it Important to you?

How I Uncover a Vendor’s or Client’s True “Why” (And Why It Matters for Strategic Partnerships) Understanding a vendor’s or client’s true motivation, purpose, and strategic intent is essential for building aligned, high-trust, long-term business relationships. As a Fractional CFO, I use a structured approach to go beyond surface-level responses and uncover the deeper “Why” …

Not All Capital Is Equal

When raising capital—whether through banks, private lenders, or investors—it’s essential to evaluate the quality of the capital and the partner behind it. The wrong financial partner can slow growth, limit opportunities, and create misalignment that hurts your business long term. Here are the key factors every business should assess when choosing the right financial partner: …

Here are 20 compelling, SEO-optimized reasons why businesses should use fractional services to strengthen, protect, and scale their operations:

1. Cost-Effective Leadership:Fractional executives deliver senior-level expertise at a fraction of the cost of full-time hires, helping businesses maximize ROI. 2. Flexible Engagement Models:Support scales up or down based on business needs, making fractional services ideal for dynamic or growing organizations. 3. Immediate Availability:Fractional leaders can begin contributing right away, avoiding the delays of traditional …

Customer Loyalty Programs Are Vitally Important in A SMB World

Customer loyalty programs represent a powerful strategy for SMBs to retain clients more cost-effectively than acquiring new ones, while fostering meaningful relationships rather than mere transactional connections. Here are the key benefits and reasons why loyalty programs are important: Cost-Effectiveness of Retention Building Deeper Relationships Enhanced Revenue and Customer Insights Competitive Differentiation and Brand Advocacy …

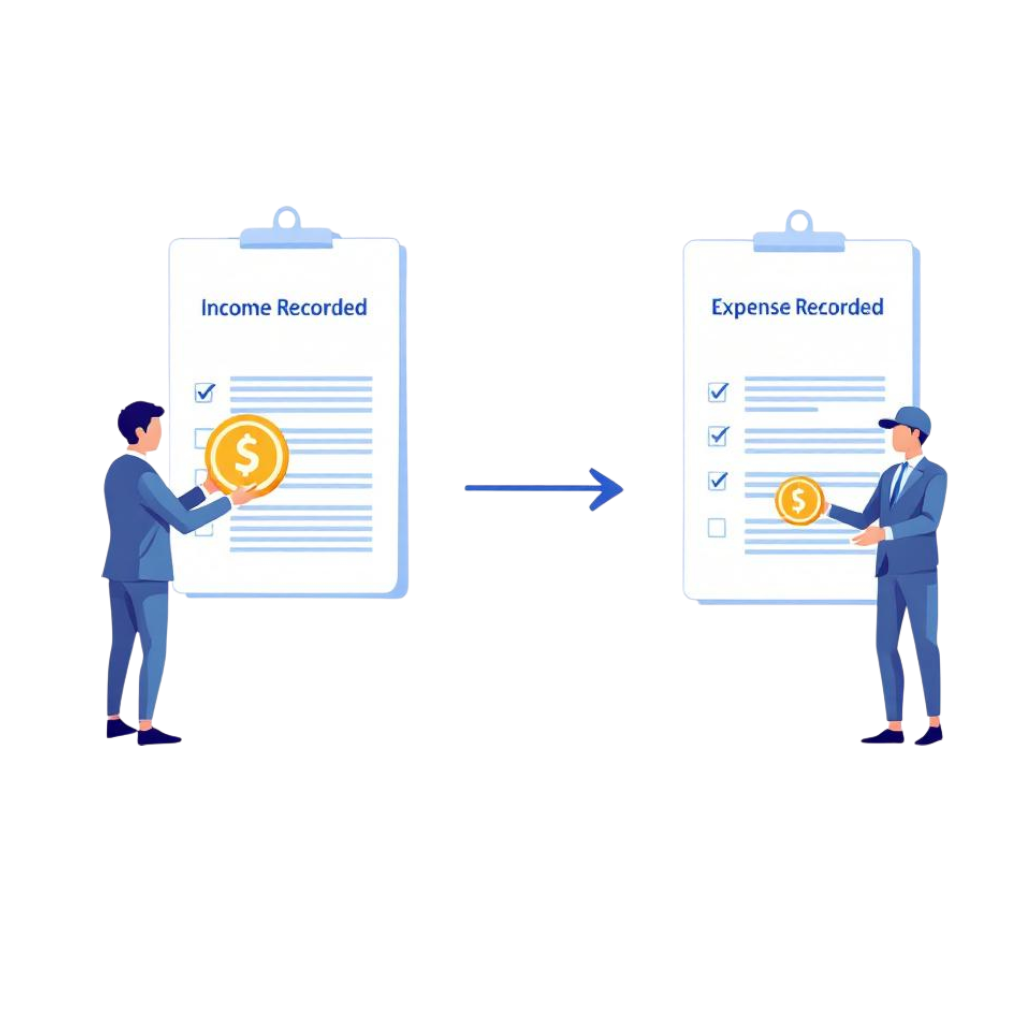

Beyond the Basics – Think Bigger: Why SMBs Can’t Afford to Be Short-Sighted in Choosing Cash vs. Accrual Accounting

My perspective as a seasoned CFO aligns with widely accepted financial principles: accrual accounting is the most accurate method for reflecting a company’s true financial health. As highlighted below, accrual accounting recognizes revenues and expenses when they occur—not merely when cash is exchanged—providing a clear, real-time, and holistic view of operating performance and financial position. …

“Success in saturated markets doesn’t come from following the crowd; it comes from creating your own path where competition is irrelevant.” – Adapted from Blue Ocean Strategy

Understanding Market Saturation and Its Impact on SMB Growth Market saturation occurs when a product or service has reached the majority of its total addressable market, leaving fewer opportunities for natural expansion. In these highly competitive environments, SMBs often find themselves fighting for existing market share instead of unlocking new demand. As a fractional CFO …

When business growth outpaces cash. What Now?

When Business Growth Outpaces Cash Flow: Understanding the Risk When business growth outpaces cash alignment, a company’s sales and operations expand faster than its available cash or financing can support, creating significant financial risk. Rapid increases in revenue, new contracts, or market expansion often lead to rising receivables, inventory, and payroll obligations long before cash …

What to Know Before Taking Out a Small Business Loan: Key Financial Considerations for SMBs

For small and medium-sized businesses, taking out a loan can unlock growth—but it can also create new risks if not approached strategically. If you’re exploring financing, knowing what to consider before taking out a small business loan is essential for protecting your company’s financial health and future. Below are the key financial considerations SMBs should …

Cash Flow Forecast Worksheet

Why Every Business Needs a Cash Flow Forecast Worksheet (and a Free Template to Get You Started) Profit doesn’t always equal cash—and that’s where many business owners get caught off guard. Even healthy, growing companies can find themselves struggling to make payroll or cover expenses because they didn’t anticipate a short-term cash crunch. That’s why …

SMB Data Security: A CFO’s Responsibility

As a CFO serving small and mid-sized businesses, I’ve seen how easily an overlooked data security gap can derail even the best-run enterprises. With modern ransomware demands now averaging $2.7 million per incident and most business breaches starting with a simple phishing email, our role in financial stewardship now includes protecting operational resilience against cyber …

How Much Cash Should a Small Business Keep in Reserve?

For small and medium-sized businesses, maintaining a healthy cash buffer is essential for long-term success. Whether you’re running a local service company, a SaaS startup, or a construction firm, having cash reserves gives you the freedom to weather downturns, cover emergency expenses, and pursue growth without added financial stress. But have you ever wondered, “How …

What the New 1099 Reporting Changes Mean for Your Taxes

The landscape for IRS 1099 reporting has changed significantly in 2025 due to new legislation. The One Big Beautiful Bill Act, effective July 4, 2025, brings higher reporting thresholds, reduced paperwork for many filers, and new compliance rules for businesses, freelancers, and gig workers. Major Changes: Higher 1099 Thresholds Form 1099-K (Third-Party and Card Payments): The …

Best Practices to Hire a Fractional CFO for Construction Companies

Running a construction company means balancing far more than projects and payroll. Between fluctuating material costs, seasonal cash flow, and complex compliance requirements, financial oversight can make or break a project. That’s where a fractional CFO comes in. A fractional CFO gives construction companies access to senior-level financial expertise without the full-time cost. They can …

10 Warning Signs of Employee Theft for Owners and CEOs

In a small or medium-sized enterprise (SME), trust refers to the reliance that owners, leaders, and employees place on one another to act with integrity, fulfill responsibilities, and support the company’s best interests. Trust in an SME is often built through close relationships, frequent interactions, and a sense of shared purpose—fostering collaboration, agility, and a …

The 5 Business Mistakes I See Over and Over (Even in $5M+ Companies)

You’d think that once a company reaches $5M+ in revenue, the biggest mistakes are behind them. But in over 30 years of working with CEOs, I’ve seen that even established businesses fall into a handful of recurring and valuation‑eroding traps. Let’s unpack them and how each affects the value buyers see in your business. 1. …

Is Your Cash Flow Forecasting Lying to You?

Cash flow forecasting is one of the most important tools a business can use—but also one of the most misunderstood. Many business owners believe they have a strong handle on their company’s cash position. They have a spreadsheet. Or maybe a report their bookkeeper runs each month. It feels like enough. But here’s the problem: …

Optimizing Manufacturing Key Performance Indicators (KPIs)

In today’s competitive manufacturing landscape, measuring and optimizing performance is crucial for success. This white paper outlines the essential key performance indicators (KPIs) that manufacturing companies should track and provide strategies for effective implementation. By focusing on these metrics, manufacturers can enhance productivity, quality, and profitability while driving continuous improvement across their operations. Introduction Manufacturing …

Construction Accounting Methods

When it comes to managing finances in the construction industry, traditional accounting simply doesn’t cut it. Project-based work, long timelines, and complex tax rules require specialized knowledge. For any construction CFO, choosing the right accounting method is essential for staying compliant, improving cash flow, and maximizing profitability. Below is a breakdown of the most common …

The Labor Market’s Cooldown

As the U.S. labor market cooldown continues through mid-2025, small businesses are navigating a landscape defined by lower hiring intentions, wage growth tapering, and lingering uncertainty about demand and costs. Through my – the strategic lens of a Fractional Chief Financial Officer, the impact of these shifts on operations, efficiency, cash flow, and profitability is …

Integrating R&D Tax Credits into a Holistic Tax Minimization Strategy

Research and Development (R&D) tax credits are a powerful tool for reducing tax obligations and supporting innovation-driven growth. When strategically integrated into a company’s overall tax planning, these credits can significantly enhance cash flow, lower effective tax rates, and provide a competitive edge. Understanding the R&D Tax Credit The R&D tax credit is a federal …

Mastering Cash Flow Forecasting for Manufacturing

For small manufacturers, cash flow forecasting isn’t just a financial task—it’s mission critical. With challenges such as long production cycles, upfront costs, and delayed receivables, one missed projection can stall operations or put growth plans at risk. But with the right systems and habits in place, forecasting becomes a powerful tool for planning and protecting …

5 Cash Flow Forecasting Tips for Small Businesses

For many small business owners, cash flow can feel unpredictable. Some months are steady, others are tight—and without a clear picture of what’s coming, it’s hard to make confident decisions. But cash flow forecasting changes that. It gives you visibility, control, and the ability to plan ahead. Here are five ways to strengthen your forecasting …

10 Functions This CFO Recommends Outsourcing to Scale Smarter

After decades in finance, one thing has become clear: small business owners wear too many hats. And while that hustle is admirable, it’s not always efficient—or sustainable. If the goal is to grow with clarity and control, outsourcing isn’t just helpful—it’s essential. Here are the top 10 business functions I recommend outsourcing to scale with …

The Real Cost of Employee Turnover

Employee turnover isn’t just an HR problem—it’s a financial one too. When employees leave, it costs time, money, and productivity. For Fractional CFOs and business owners, understanding the full cost of employee turnover is key to protecting profits and keeping things running smoothly. What Does Turnover Really Cost? When an employee leaves, the cost can …

10 Things a Business Owner Should Avoid at All Costs

Running a business is full of challenges, and while some mistakes are part of the learning process, others can seriously jeopardize your success. Whether you’re just getting started or managing a growing operation, understanding the most common pitfalls can help you stay focused, protect your investments, and build a strong foundation. Here’s a closer look …

5 Risky Moves When You’re Desperate for Business Cash Flow

When cash gets tight, it’s natural to start looking for creative solutions, but not all ideas are created equal. In fact, some “quick fixes” can dig the business into a deeper financial hole. Whether it’s raiding personal savings, overextending credit, or taking risky customer deposits, the short-term relief often comes with long-term consequences. If you’re …

The Evolving Role of a CFO

The role of the Chief Financial Officer (CFO) has undergone a significant transformation in recent years, evolving from a traditional financial steward to a strategic business partner. According to recent analyses, CFOs are now at the forefront of digital transformation, ESG initiatives, and strategic decision-making, while facing increased pressure and shorter tenures in their positions. …

Why you need a CFO and a CPA

While both CPAs and CFOs play crucial roles in financial management, they have distinct responsibilities and skill sets. Here are 10 reasons why you need a CFO and a CPA. Strategic Focus They take a holistic approach to financial planning, budgeting, and forecasting, which goes beyond the typical scope of a CPA’s duties. Leadership and …

The Value in Obtaining a Business Valuation

Q: What is the value of obtaining a valuation for Financial Planning For all business owners, a must have – understanding the value of their business plays a major role in determining whether they’ll reach their personal financial goals, should they exit. Only approximately 2% of business owners, know their business real value. Q: What …

3 Out of 4 Small Partnerships Aren’t Prepared for the Future- Are You One of Them?

A troubling statistic from Forbes reveals that a whopping 75% of small businesses lack a Buy-Sell Agreement. That’s like playing Russian roulette with your future and the future of your loved ones. Let’s face it, nobody wants to think about death or disaster, but when it comes to your business, having a plan in place …

Why Waiting Until It’s Broken Can Break Your Business

In the world of entrepreneurship, there’s a saying that if it isn’t broken, don’t fix it. While this mindset can save resources and maintain stability, it also risks stagnation and missed opportunities. By focusing on proactive strategies, entrepreneurs can protect their business’s fiscal health, optimize processes, and stay ahead of the competition. The Pitfall of …

Mileage Rates for 2024 Announced by IRS -Updated

The IRS has recently released the optional standard mileage rates for 2024. These rates are used to determine deductible costs when using a vehicle for business, charity, medical, or moving purposes. The rates are applicable to a wide range of vehicles, including those powered by gasoline or diesel, as well as hybrid and electric vehicles. …

Maximizing the Value of Your Variance Report (Budget to Actual):

Variance report is an essential tool for small business owners to gain insight into their financial performance and keep track of their expenses. It is a report that compares budgeted amounts to actual amounts, highlighting areas of over or under-spending. However, with so much data to consider, it can be difficult to interpret the results …

How to Create a Detailed Cashflow Budget

A cashflow budget is an important tool that every business owner should have. It helps to ensure that your business has enough cash to meet all its needs, including payroll, inventory, and other expenses. A cashflow budget can also help you identify potential cash shortfalls and take steps to avoid them. While creating a cashflow …

What are Virtual CFO Services?

Virtual CFO services refer to financial management and advisory services that are offered remotely, rather than in-person. This type of service is becoming increasingly popular as businesses look for ways to reduce costs and increase efficiency. One of the main benefits of virtual CFO services is that they provide a cost-effective solution for businesses that …

Budgeting is a crucial aspect of financial management

There are two main approaches to budgeting: driver-based budgeting (DBB) and zero-based budgeting (ZBB), both of which are known for improving FP&A processes. Each method has its own advantages and is suitable for different industries, depending on their specific characteristics and requirements. We will delve into the distinctions between DBB and ZBB and analyze why …

Hiring A Fractional CFO

Hiring a fractional CFO can be a game-changer for small business owners, startup founders, managing members, and CEOs. A fractional CFO brings expert financial management without the cost of a full-time executive. However, to make the most of this partnership, you need to know how to engage your fractional CFO effectively. Here’s a step-by-step guide …

When to Engage a Fractional CFO

Navigating the financial landscape of any size business can be challenging. Knowing when to engage a Fractional CFO can set you up for success and ensure your company’s financial health. Here’s a guide to help you identify that right moment. Why Consider a Fractional CFO? They provide high-level financial strategy and expertise without the full-time …

Corporate Transparency Reporting Rules

As of January 1, 2024, the U.S. government will mandate most businesses to disclose additional details about individuals who exert direct or indirect control over the company. This involves revealing information about owners, officers, and key operators. This change stems from the Corporate Transparency Act, which Congress passed in 2021 with the objective of curbing …

Understanding 1099 Compliance Requirements

Maintaining compliance with tax laws and regulations is a critical responsibility for any organization. Among the many requirements that businesses must adhere to is the 1099 compliance. A 1099 is a tax document that is issued to non-employees, such as independent contractors, freelancers, and vendors, for income they received from a business. Failing to comply …

Tax Relief Post-Hurricane Helene

If Hurricane Helene has impacted your business, there’s crucial news from the IRS. On October 1, 2024, they issued Notice 2024-253, extending tax filing and payment deadlines to May 1, 2025, for areas affected by Hurricane Helene, as designated by FEMA. This includes Alabama, Georgia, North Carolina, South Carolina, parts of Florida, Tennessee, and Virginia. …

Understanding the New Clean Vehicle Tax Credit

2023, the IRS has implemented a revamped tax credit for electric vehicles. While this isn’t entirely new—formerly known as the Plug-In Electric Drive Motor Vehicle Credit—the IRS has rebranded it as the Clean Vehicle Tax Credit under the Inflation Reduction Act. With this change comes a new set of qualification criteria you’ll want to understand …

Section 1202 (IRS Code) Qualified Small Business Stock Gain Exclusion (QSBS) Implications

Section 1202 of the Internal Revenue Code, often referred to as the Qualified Small Business Stock (QSBS) Gain Exclusion, is a powerful tax incentive designed to encourage investment in small businesses. For small business owners and investors, it can mean substantial tax savings when selling certain types of stock in qualifying companies. What Does IRS …

10 Reasons To Involve A Fractional CFO in Annual Budgeting

Annual budgeting is a crucial process for any business, big or small. It involves creating a financial plan for the upcoming year and helps in determining how much money needs to be allocated to different areas of the business. This process requires careful analysis, forecasting, and strategic decision making. 1. Financial Expertise A CFO, or …

Bonus and severance programs: Key strategy to reduce employers’ legal risk

You and your Finance team may want to give your bonus and severance programs a second look. It’s important to make sure they’re aligned with federal standards, if possible. Otherwise, you may have to deal with tricky state wage laws in any legal disputes. Many state laws are more favorable to employees. This makes it …

Is it illegal for employers to ask about salary history?

In addition to numerous federal, state, and local employment laws, which prohibit gender and racial discrimination against employees, several states and cities are banning inquiries into salary history in an effort to address pay inequities for women and minorities. Employee advocates claim that, in determining an employee’s salary based on their previous salary, employers exacerbate …

Do Criminal Background Checks Violate Title VII

President Biden’s recent campaign stop at a Sheetz convenience store ended in an unexpected twist. While sipping on his cup of coffee and chatting with employees and customers, little did he know that Sheetz had something else brewing in the background. The company was hit with a lawsuit by the Equal Employment Opportunity Commission (EEOC) …

Is the New DOL Overtime Rule a Boon or a Burden for American Workers?

The Department of Labor’s (DOL) recent release of its final overtime rule has grabbed headlines for its sizable impact on millions of American workers. The changes enforce minimum earnings that are the bedrock of fair labor practices, yet the scope of their reach is stirring a potpourri of reactions. Is the new rule symbolizing a …

This is Business – Keep Emotions out.

Google’s CEO Sundar Pichai recently published a blog post discussing the company’s reorganization to focus on artificial intelligence. While he doesn’t specifically address the recent firing of employees, Pichai highlights the importance of preserving a culture of open discussion while also acknowledging that ultimately Google is a business. He emphasizes that Google is not a …

Who Does What? Understanding CFOs, Bookkeepers and CPAs

CFOs (Chief Financial Officers), Bookkeepers and CPAs (Certified Public Accountants) all help manage a business’s money, but they each have different jobs and levels of responsibility. CFO (Chief Financial Officer) CFOs are top-level managers in charge of a company’s financial plan and strategy. Their main jobs include: CFOs have a lot of experience in finance …

What is a Fractional CFO (Chief Financial Officer)?

A fractional (CFO) provides businesses with high-level financial expertise on a part-time basis. This role is ideal for companies that need strategic financial guidance but can’t justify the cost of a full-time CFO. Businesses of all sizes, from startups to mid-sized companies, can benefit from having an experienced financial leader without the long-term commitment. What …

Why Startups Need a Fractional CFO

A fractional CFO for business startups helps new companies navigate financial challenges, plan for growth, and avoid costly mistakes. Because, starting a business is exciting, but managing finances can be overwhelming. What is a Fractional CFO for Startups? They are a financial expert who provides part-time CFO services to startups. They help new businesses with financial planning, cash …

Where are we today with the Business Ownership Information (BOI) Requirements – January 9, 2025.

The Beneficial Ownership Information (BOI) reporting deadlines have undergone several changes due to recent legal developments. Here are the current key deadlines for BOI reporting: Existing Companies Reporting companies created or registered before January 1, 2024, now have until January 13, 2025, to file their initial BOI reports with FinCEN. This is an extension from …

Payroll Tax Changes for 2025

In 2025, several changes to payroll taxes and related deductions are being implemented across various states and at the federal level. Here’s an overview of the most significant updates: Federal Payroll Taxes – Social Security Taxable Wage Base: The taxable wage base for Social Security is increasing to $176,100 in 2025. This means that earnings above …

Tax Deductions available for Startups in 2025

Below is a list of tax deductions available for startup businesses in 2025. Remember to keep detailed records of all expenses and consult with a tax professional to ensure you’re complying with IRS regulations. Employee benefits and healthcare: Including retirement plan contributions and wellness program costs. Lastly, check your local state legislation for local tax …