Fractional CFO Services for Construction Companies in Georgia

Empowering businesses to make confident, data-driven decisions for growth with a Beyond the Balance Sheet approach.

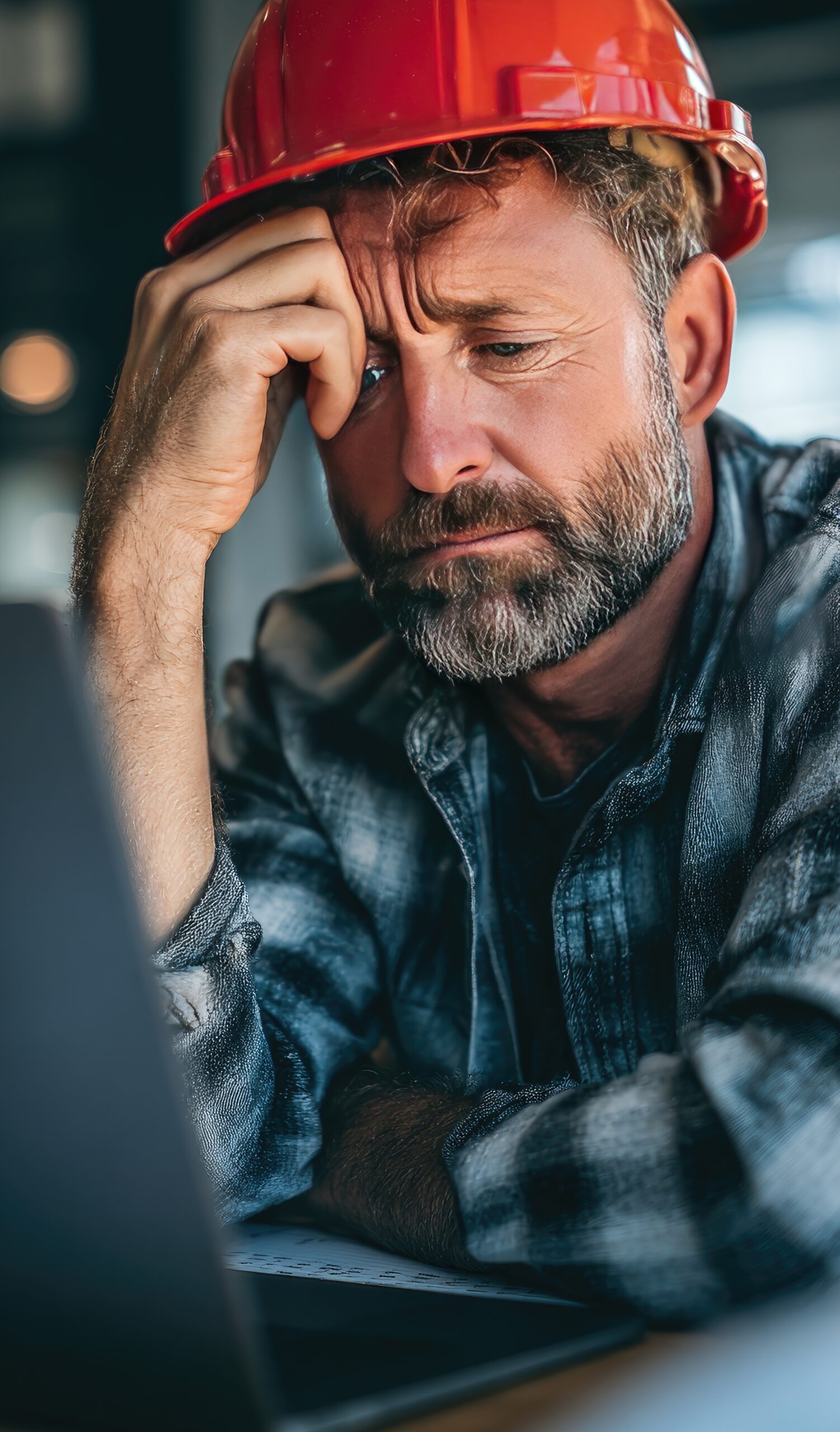

Schedule Your Free Financial Consultation Request a Call BackTruth: Financial Management Should Be One of the Biggest Driver’s of Growth for Your Construction Business

Fact: The “today state” of financial management is one of the biggest roadblocks of growth for millions of US-based businesses.

Sound Familiar?

Job costing is inaccurate, untimely, incomplete or unclear.

Labor productivity needs improvement, and I need to measure workforce efficiency on your projects?

What asset utilization? What’s that…

Project cash flow is inconsistent and lumpy. It impacts the ability to manage multiple projects simultaneously.

Quality defects are costly. How do I quantify this? How do I monitor this?

Real-time profitability is hard to measure.

Our Clients’ Experience

Net Cash Flow & Working Capital: Tracks financial health, liquidity, and ability to cover obligations during projects.

Cost Performance Index (CPI): Compares actual costs to budgeted/earned value; monitors for overruns or cost savings on projects

Production Construction Costs & Unit Costs: Tracks direct and indirect costs per unit produced—essential for margin control and pricing decisions

Proactive Decision Action – Risk is identified and addressed before it becomes a problem.

Timely Accurate Financial Statements are audit-ready and in full compliance.

KPI driven action plan.

Our Services

Our Boutique Approach Delivers Services Precisely Matched to Your Business Needs

CFO Services

- Board Presentation & Participation

- Capital Formation & Investor Relations

- Cash Flow Management

- Cost Control & Profitability Initiatives

- Financial Planning & Analysis

- Financial Reporting & Compliance

- Mergers, Acquisitions, and Transactions

- Risk Management

- Routine Accounting Oversight

- Strategic Financial Management

- Systems Implementation & Process Improvement

- Team Development & Stakeholder Engagement

- Vendor and Contract Negotiation

Controller Services

- Budgeting, Forecasting & Planning

- Core Accounting & Financial Management

- Financial Reporting & Compliance

- Financial Strategy & Analysis

- Internal Controls & Process Improvement

- Staff Supervision & Training

- System Implementation & Optimization

Accounting Services

- Daily Transaction Management

- Account Reconciliations & Maintenance

- Financial Reporting & Documentation

- Payroll & Sales Tax Support

- System & Workflow Support

- Communication & Process Improvement

Back Office Support

- Accounting & Bookkeeping Support

- Administrative & Operational Support

- Compliance & Documentation

- Financial Reporting & Analysis

- Payroll & HR Administration

- Systems & Process Optimization

Being the catalyst that unlocks a business’s true growth potential is some of the most rewarding work a person can do.

We look forward to getting to know you, your business, and your goals and helping you understand how we can help!

Stan Alhadeff | Founder

Clients Who’ve Benefited from Our Fractional CFO Services:

Experience Financial Freedom by Going Beyond Your Balance Sheet

At Business CFO for Hire, we understand the challenges construction businesses face when it comes to navigating their finances. Our experienced CFOs are here to guide you through every step of the process.

Schedule Your Free Financial Consultation30+ years of diverse financial management experience.

Expert fractional CFO experience working with businesses from startups to $1B+ enterprises.

Proven results: Helping clients identify over 20% in savings within the first year. Securing $ 1.5 million in alternative funding.

Goes beyond your balance sheet to develop holistic business strategies for growth.

Customized packages.

Do You Have the Right Visibility and Clarity into Your Construction Business Financials to Make Informed Decisions for Growth?

Worrying about cash flow management.

Struggling with financial forecasting.

No compliance strategy in place.

Missing KPI tracking opportunities.

Neglecting capital sourcing opportunities.

Feeling like you’re flying blind financially.

Unsure how to prepare to sell your business.

Uncertain about accurate measurement of profitability.

Stan Alhadeff is highly recommended for his exceptional work as a fractional CFO for the construction company, Fincher Services. Stan was engaged to navigate a period of significant growth and structural change. His expertise proved invaluable in several key areas.

Stan’s impact on corporate strategy was immediate and profound. He has a keen understanding of the construction industry’s unique financial landscape. He helped clarify long-term goals and developed a strategic roadmap to achieve them, translating vision into concrete, actionable steps. His insights were instrumental in identifying key performance indicators (KPIs) relevant to operations and guiding the leadership team in making informed decisions about future trajectory.

One of Stan’s critical contributions was his guidance in defining the correct legal entity for the growing enterprise. His expertise ensured that the corporate structure was optimized for tax efficiency and legal compliance, safeguarding assets and setting a solid foundation for continued expansion. He also meticulously reviewed and updated the operating agreement, ensuring it reflected the new strategic direction and adequately addressed potential future scenarios.

Beyond strategic planning, Stan spearheaded a much-needed upgrade to the accounting system. This was a complex undertaking, involving the transition to a more robust platform and the implementation of more efficient internal controls. His leadership ensured a smooth and successful integration, improving financial reporting accuracy and providing greater transparency into operations.

Furthermore, Stan was instrumental in the integration of appropriate software solutions across various departments. He recognized the potential for increased efficiency and cost savings through technology adoption and worked diligently to identify, implement, and optimize new systems that streamlined workflows and enhanced overall productivity.

Stan is a highly analytical, flexible, and creative problem-solver. He approaches challenges with a strategic mindset and a commitment to achieving sustainable growth.

His ability to effectively communicate complex financial concepts to the team and foster a data-driven culture was particularly impactful. The contributions were instrumental in recent successes.

He is highly recommended to any construction company seeking a strategic financial partner.

Fincher Services | VP

Atlanta, Georgia

Construction Expertise You Can Count On

Our fractional CFOs have deep insights in the construction sector. Understanding how every area of your business impacts financial health enables you to make confident, data-driven decisions that propel your business toward achieving its goals.

Get Started Today

STEP 1

Discover

Schedule a free financial consultation to get immediate insights and learn more about how our services can empower your business growth.

STEP 2

Diagnose

We’ll complete a financial audit and create a tailored plan to address your specific challenges.

STEP 3

Achieve Clarity

With our ongoing support, you’ll Understand your financial health and make confident decisions based on data.

Why Work with Us?

2,000+ Happy Clients

30+ Years of Experience

100% Satisfaction

Stan has been instrumental in helping 5th Method achieve financially stable and steady growth over the last 8 years.

Ron | Founder- IT App Service Provider

The CFO Knowledge Center

Hiring a CFO to “Make the Numbers Look Good” Is a Costly Mistake

Fractional CFO for SMB: Always Be Closing the Financial Gap

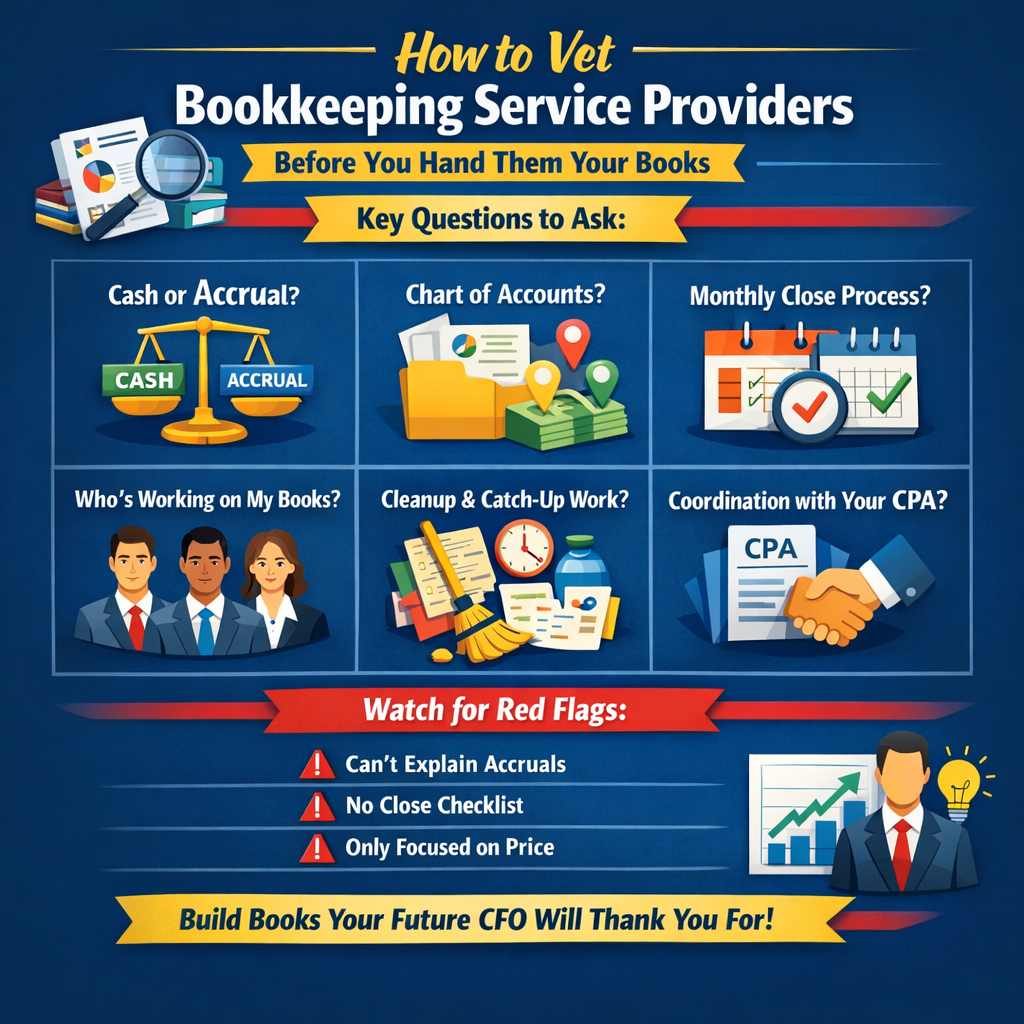

How to Vet Bookkeeping Service Providers (Before You Hand Them Your Books)

Faq’s

What does a construction fractional cfo in Georgia do?

Construction projects need tight control. A construction fractional cfo in Georgia from Business CFO For Hire manages costs, forecasting, and financial risk.

How do construction cfo services in Florida manage project costs?

Cost control is critical in construction. Construction cfo services in Florida from Business CFO For Hire improve budgeting, forecasting, and margin protection.

Why use outsourced construction cfo in Alabama?

Outsourcing adds expertise without overhead. Outsourced construction cfo in Alabama from Business CFO For Hire supports profitability and financial discipline.

How does construction financial management in North Carolina reduce overruns?

Strong controls prevent surprises. Construction financial management in North Carolina from Business CFO For Hire improves tracking and proactive cost control.

Why are construction company cfo services in South Carolina important?

Complex projects demand oversight. Construction company cfo services in South Carolina from Business CFO For Hire support cash flow and long‑term stability.