What Are Fractional CFO Services?

A fractional CFO is an experienced financial professional who provides CFO-level guidance on a part-time or contract basis. Unlike a full-time CFO, a fractional CFO works with multiple businesses, offering strategic financial expertise without the high costs of a salaried executive. This service is particularly valuable for startups, small businesses, and growing companies that need financial leadership but don’t yet require a full-time hire.

Fractional CFOs bring deep financial expertise across various industries, helping businesses that lack the resources for an in-house CFO. They work flexibly, either as an ongoing resource or for specific financial projects, such as fundraising, cost optimization, or financial restructuring. Their involvement can range from high-level strategy to hands-on financial management, depending on a company’s needs.

For companies considering hiring a Fractional CFO, understanding their role in financial strategy and operations is crucial.

Why Hire a Fractional CFO?

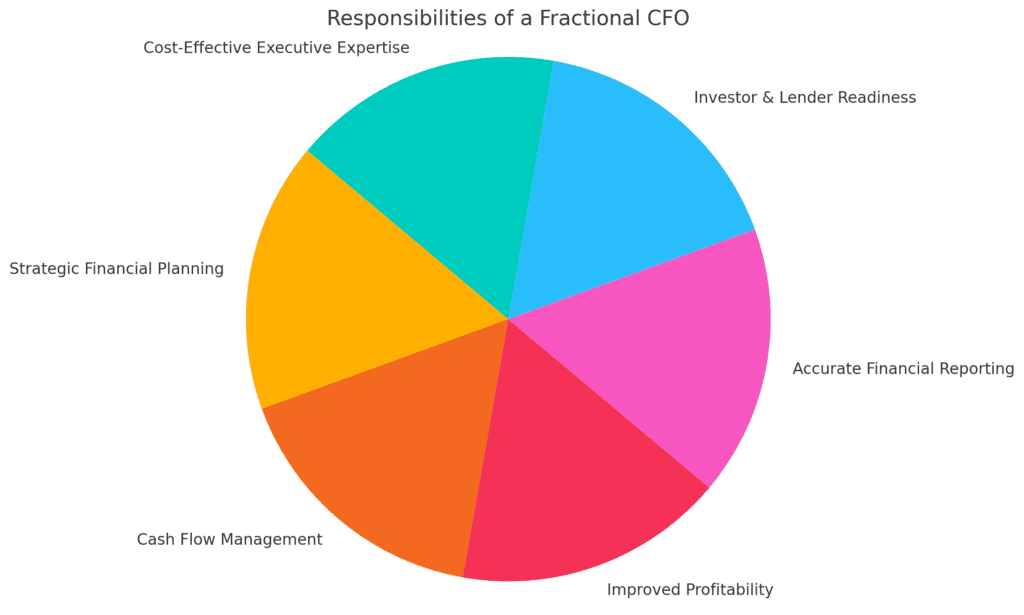

Many business owners struggle with financial management as their company scales. A fractional CFO helps bridge the gap between basic bookkeeping and having a dedicated financial leader. Here’s how a fractional CFO can help:

Financial Strategy & Planning

A Fractional CFO brings expert-level financial insight without the cost of a full-time hire, making them a smart choice for growing businesses. They help business owners see beyond daily transactions and focus on long-term financial strategy and planning. By analyzing cash flow, creating forecasts, and identifying areas for cost savings or growth, they turn financial data into confident decision making. This role provides the strategic thinking needed to set realistic goals, prepare for scaling, and avoid financial blind spots.

Cash Flow Management

Maintaining a healthy cash flow is crucial for business sustainability and long-term success. An experienced financial leader plays a key role in actively monitoring the movement of money in and out of the business, ensuring there’s always enough on hand to cover operational expenses, payroll, and growth-related investments. They help business owners avoid cash shortages by forecasting future needs and preparing for seasonal fluctuations or unexpected disruptions. In addition to safeguarding liquidity, they identify inefficiencies in the cash flow cycle—such as delayed customer payments or bloated overhead, and implement targeted strategies like renegotiating vendor terms, streamlining invoicing processes, and cutting unnecessary spending. This level of proactive oversight helps businesses not just survive, but thrive

A Fractional CFO for business startups can be particularly valuable for young companies needing real-time cash flow management. Learn more about fractional CFO services for startups.

Profitability Optimization

A business may have strong revenue but still struggle with profitability. A seasoned financial expert can uncover what’s really happening beneath the surface by conducting detailed analysis of income statements, cost structures, and operational efficiency. They help pinpoint areas of waste such as redundant expenses, underutilized resources, or underperforming products and services—and recommend strategic adjustments that protect the customer experience while reducing unnecessary costs. Beyond cost control, they play a critical role in shaping pricing strategies, ensuring offerings are not only competitive in the market but also aligned with profitability goals. This approach helps businesses retain more of what they earn and build a sustainable, scalable model for growth.

Businesses in manufacturing often need specialized financial insight. A Fractional CFO for manufacturing can help streamline costs and improve efficiency in this sector.

Funding & Investor Relations

When a business is preparing to secure investment or financing, having an experienced financial partner is essential. This professional ensures that all financial statements, forecasts, and business plans are accurate, compelling, and aligned with what lenders or investors want to see. They craft clear, data-driven presentations that highlight the company’s strengths, growth potential, and financial stability—instilling confidence in potential backers. Their involvement can also lead to more favorable funding terms by demonstrating credibility and reducing perceived risk. Once funding is secured, they continue to support investor relations by delivering timely updates, transparent reporting, and performance insights that strengthen trust and foster long-term partnerships.

For businesses actively raising capital, hiring a fractional chief financial officer can be a strategic move.

Financial Reporting & Compliance

Proper financial reporting is the foundation of smart business decisions and regulatory compliance. A skilled financial leader takes responsibility for ensuring that all financial data is accurate, timely, and aligned with current tax laws, GAAP standards, and any industry-specific regulations. This level of precision not only supports internal decision making such as budgeting, forecasting, and performance tracking—but also protects the business from potential audits or fines. They establish reliable systems for bookkeeping and reporting, implement checks to prevent errors, and work closely with accountants and auditors to ensure compliance. By creating a culture of financial transparency, they empower business owners with the clarity and confidence needed to lead effectively and grow responsibly.

Fractional CFO vs. Full-Time CFO: Which One Is Right for You?

A full-time CFO is a great option for larger companies with complex financial needs, but a fractional CFO is often the better choice for small to mid-sized businesses looking for expert guidance at a fraction of the cost. Here’s a comparison:

| Feature | Fractional CFO | Full-Time CFO |

| Cost | Lower (part-time) | High (six-figure salary) |

| Commitment | Flexible (as needed) | Full-time employee |

| Expertise | High (varied industry experience) | High (industry-specific expertise) |

| Scalability | Easily adjusted to business needs | Fixed salary regardless of needs |

If you need expert financial oversight but can’t justify the cost of a full-time CFO, a Fractional CFO is likely the better option.

Conclusion: Is a Fractional CFO Right for Your Business?

Hiring a Fractional CFO can be a game-changer for businesses looking to scale efficiently, improve cash flow, and enhance financial decision-making. Whether you’re a startup, a growing company, or an established business needing financial clarity, this option provides the expertise you need—without the full-time cost.

Here are 5 questions a business should ask to determine if consulting with a CFO would be beneficial:

Is financial management taking too much of the owner’s or executive team’s time—or being neglected altogether?

If you’re spending too much time in the weeds (or avoiding the numbers), bringing in a specialist can help you focus on what you do best.

Do we have clear, accurate financial reports that help us make informed decisions?

If your reports are confusing, inconsistent, or delayed, expert financial guidance could help bring clarity and structure.

Are we confident in our cash flow management and financial forecasting?

If you’re unsure how much cash you’ll have in 3, 6, or 12 months, it’s time to get help building better projections.

Do we understand which parts of our business are truly profitable?

Without a clear view of profit margins by product, service, or department, you may be scaling the wrong things.

Are we planning for growth, funding, or exit—but unsure how to prepare financially?

Whether you’re seeking investors, loans, or long-term planning, strategic financial insight can make or break your success.

Ready for a complimentary consultation? Schedule yours today.