Choosing the right fractional CFO is one of the highest-leverage decisions a founder or CEO can make. The right partner elevates strategy, sharpens execution, and protects enterprise value. The wrong one quietly amplifies risk, stalls growth, and erodes credibility with lenders and investors.

Because fractional CFOs sit at the intersection of strategy, cash, and execution, this decision deserves the same rigor as any major capital allocation choice.

Why Choosing the Right Fractional CFO Matters So Much

The CFO role influences nearly every material decision in a business: pricing, hiring, investment, financing, and risk. A poor CFO choice often creates second-order effects—weak forecasting, bad capital decisions, and fragile controls—that can take years to unwind.

For SMEs using a fractional CFO model, the risk is often underestimated. While the engagement may be part-time, the decisions influenced are full-time. You are still handing this person the steering wheel for cash management, capital allocation, and financial credibility.

A strong fractional CFO, by contrast, brings:

- Structured forecasting and scenario planning

- Disciplined cash and working capital management

- Data-driven decision support

- Increased credibility with banks, investors, and boards

That credibility alone can materially impact financing terms, covenant flexibility, and exit outcomes.

Consequences of Choosing the Wrong Fractional CFO

The downside of choosing the wrong fractional CFO rarely shows up as an obvious failure. Instead, it manifests in three predictable areas.

Financial Damage

Misaligned or underqualified CFOs often create poor budgets, weak cash visibility, and misguided investments that erode margins and liquidity. Inaccurate reporting or compliance gaps can also lead to lender friction, penalties, or restatements that damage trust.

Strategic Drift and Missed Opportunities

A fractional CFO who cannot challenge assumptions, build robust financial models, or lead through change will slow transformations, M&A activity, and growth initiatives. When financial leadership is misaligned with the company’s risk appetite or long-term goals, businesses either miss good opportunities—or pursue the wrong ones.

Cultural Friction and Reputational Risk

Poor cultural fit creates friction with the CEO and leadership team, undermining execution and morale. Externally, a visibly weak finance leader can damage credibility with investors, lenders, and strategic partners who rely on CFO judgment as a proxy for management quality.

In a fractional context, these issues are compounded by the false sense of safety that comes from “lower cost,” despite very real strategic impact.

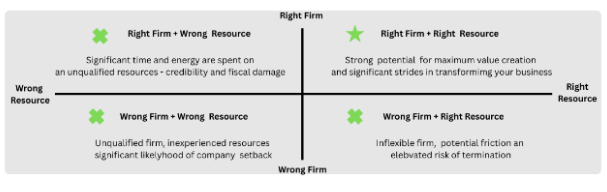

Turning Subjectivity Into Discipline: The Fit–Execution Matrix

To reduce this risk, leadership teams need a structured way to evaluate candidates beyond résumés and gut feel. A Fractional CFO Fit–Execution Matrix provides that discipline.

- X-Axis: Strategic Fit (Low → High)

Alignment with your industry, business model, company stage, culture, and owner or investor goals. - Y-Axis: Execution Capability (Low → High)

Demonstrated ability to deliver results in forecasting, cash management, capital markets, systems implementation, and transformation.

Each axis is built from clearly defined, scored criteria (for example, industry experience, stage experience, cultural fit, and goal alignment for fit; FP&A depth, capital-raising track record, systems build-out, and references for execution). Candidates are scored on a 1–5 scale and averaged into composite X and Y scores.

Plotted visually, each candidate becomes a point on the matrix—making it immediately clear who belongs in the top-right quadrant.

How to Implement the Matrix in Practice

Define Success and Weight What Matters

Clarify your 24–36 month objectives—growth, recapitalization, exit, turnaround, or professionalization—and weight criteria accordingly. A business preparing for a transaction should overweight capital markets experience and investor communication.

Score Independently, Then Plot

Have the CEO, owner, and possibly a lead investor score candidates independently. Plot the results and focus discussion on why each candidate lands where they do—not who told the best story.

Use the Quadrants to Guide Decisions

- High Fit / High Execution: Priority candidates for long-term partnership

- High Fit / Low Execution: Trusted advisors, risky as primary CFO

- Low Fit / High Execution: Useful for narrow projects, not strategic leadership

- Low Fit / Low Execution: Eliminate early

This approach transforms fractional CFO selection from a subjective hiring decision into a repeatable governance process.

Final Thought: Treat the Decision Like the Strategy It Is

Choosing the right fractional CFO is not an administrative decision—it is a strategic one. A disciplined Fit–Execution Matrix increases the odds that your financial partner accelerates strategy, protects stakeholder confidence, and compounds enterprise value over time.

The businesses that get this right don’t just hire a CFO. They choose a financial partner who helps shape their future.