Fractional Manufacturing CFO Services: Take Control of Your Business Finances

Empowering businesses to make confident, data-driven decisions for growth with a Beyond the Balance Sheet approach.

Schedule Your Free Financial Consultation Request a Call BackTruth: Financial Management Should Be One of the Biggest Driver’s of Growth for Your Business

Fact: The “today state” of financial management is one of the biggest roadblocks of growth for millions of US-based businesses.

Sound Familiar?

Getting clarity on margins at the product, customer or plant level is a struggle.

Cash flow reliability varies – and liquidity surprises are common.

Operational inefficiencies persist without clear solutions.

Financial KPIs exist, but don’t consistently drive action.

Supply chain disruptions cause delays and uncertainty.

Our Clients’ Experience

Long-term financial strategy aligns profitability and growth.

Systems provide control over cash flow and working capital.

Cost structures are optimized to improve margins and reduce waste.

Financial reporting is accurate, timely, and actionable.

Capital investments are evaluated with risk and return in mind.

Our Services

Our Boutique Approach Delivers Services Precisely Matched to Your Business Needs

CFO Services

- Board Presentation & Participation

- Capital Formation & Investor Relations

- Cash Flow Management

- Cost Control & Profitability Initiatives

- Financial Planning & Analysis

- Financial Reporting & Compliance

- Mergers, Acquisitions, and Transactions

- Risk Management

- Routine Accounting Oversight

- Strategic Financial Management

- Systems Implementation & Process Improvement

- Team Development & Stakeholder Engagement

- Vendor and Contract Negotiation

Controller Services

- Budgeting, Forecasting & Planning

- Core Accounting & Financial Management

- Financial Reporting & Compliance

- Financial Strategy & Analysis

- Internal Controls & Process Improvement

- Staff Supervision & Training

- System Implementation & Optimization

Accounting Services

- Daily Transaction Management

- Account Reconciliations & Maintenance

- Financial Reporting & Documentation

- Payroll & Sales Tax Support

- System & Workflow Support

- Communication & Process Improvement

Back Office Support

- Accounting & Bookkeeping Support

- Administrative & Operational Support

- Compliance & Documentation

- Financial Reporting & Analysis

- Payroll & HR Administration

- Systems & Process Optimization

Being the catalyst that unlocks a business’s true growth potential is some of the most rewarding work a person can do.

We look forward to getting to know you, your business, and your goals and helping you understand how we can help!

Stan Alhadeff | Founder

Clients Who’ve Benefited from Our Fractional CFO Services:

Experience Financial Freedom by Going Beyond Your Balance Sheet

At Business CFO for Hire, we understand the challenges manufacturing businesses face when it comes to navigating their finances. Our experienced CFOs are here to guide you through every step of the process.

Schedule Your Free Financial Consultation30+ years of diverse financial management experience.

Expert fractional CFO experience working with businesses from startups to $1B+ enterprises.

Proven results: Helping clients identify over 20% in savings within the first year. Securing $ 1.5 million in alternative funding.

Goes beyond your balance sheet to develop holistic business strategies for growth.

Customized packages.

“Stan Alhadeff has served as our Fractional Chief Financial Officer in excess of 10 years, delivering exceptional financial leadership and strategic oversight that greatly contributed to our company’s growth and operational excellence.

He led initiatives to streamline financial processes, improve reporting accuracy, and implement effective cost-control measures.

These improvements resulted in enhanced transparency and more agile decision-making.“

Jeff Cammllarie | CEO

Atlanta, Georgia

“Stanley Alhadeff serves as our Fractional Chief Financial Officer, since 2017 providing expert financial leadership and strategic guidance that significantly enhanced our operational efficiency and long-term growth prospects.

Impact:

- Operational Excellence: Stanley’s leadership resulted in optimized processes for front office and manufacturing, improved cash flow management and overall coaching up to move into a higher and better position for our customers and our people.

- Operational Excellence: Stanley’s leadership resulted in optimized processes for front office and manufacturing, improved cash flow management and overall coaching up to move into a higher and better position for our customers and our people.

- Long-Term Value: Stanley’s contributions have left a lasting positive impact on our organization, enhancing our financial stability and setting a strong foundation for future growth.

Recommendation:

We highly recommend Stanley Alhadeff to any organization seeking a seasoned, insightful, and results-driven CFO. His blend of technical expertise, strategic vision, and collaborative leadership make him an invaluable asset to any executive team.

As a small business, we have especially benefited from the fractional concept offered to us. We had never been exposed to that before, however, it has been an exceptional solution for LitraMFG.

Kerrie Murphy | President

Atlanta, Georgia

Do You Have the Right Visibility and Clarity into Your Business Financials to Make Informed Decisions for Growth?

Worrying about cash flow management.

Struggling with financial forecasting.

No compliance strategy in place.

Missing KPI tracking opportunities.

Neglecting capital sourcing opportunities.

Feeling like you’re flying blind financially.

Unsure how to prepare to sell your business.

Uncertain about accurate measurement of profitability.

Manufacturing Expertise You Can Count On

Our fractional CFOs have deep insights in the manufacturing sector. Understanding how every area of your business impacts financial health enables you to make confident, data-driven decisions that propel your business toward achieving its goals.

Get Started Today

STEP 1

Discover

Schedule a free financial consultation to get immediate insights and learn more about how our services can empower your business growth.

STEP 2

Diagnose

We’ll complete a financial audit and create a tailored plan to address your specific challenges.

STEP 3

Achieve Clarity

With our ongoing support, you’ll understand your financial health and make confident decisions based on data.

Why Work with Us?

2,000+ Happy Clients

30+ Years of Experience

100% Satisfaction

Stan has been instrumental in helping 5th Method achieve financially stable and steady growth over the last 8 years.

Ron | Founder- IT App Service Provider

The CFO Knowledge Center

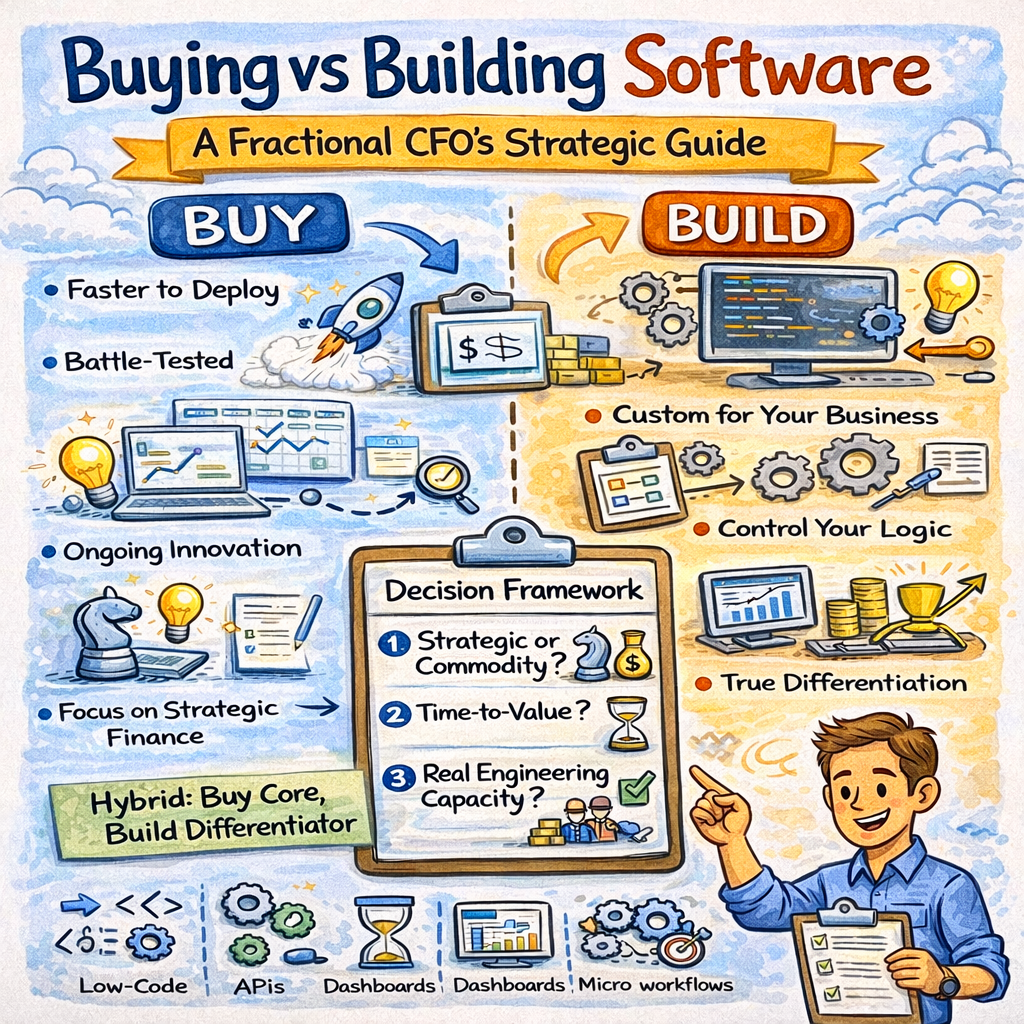

Buying vs Building Software: CFO Decision Guide

When Is the Right Time to Request a Line of Credit for Your SMB?